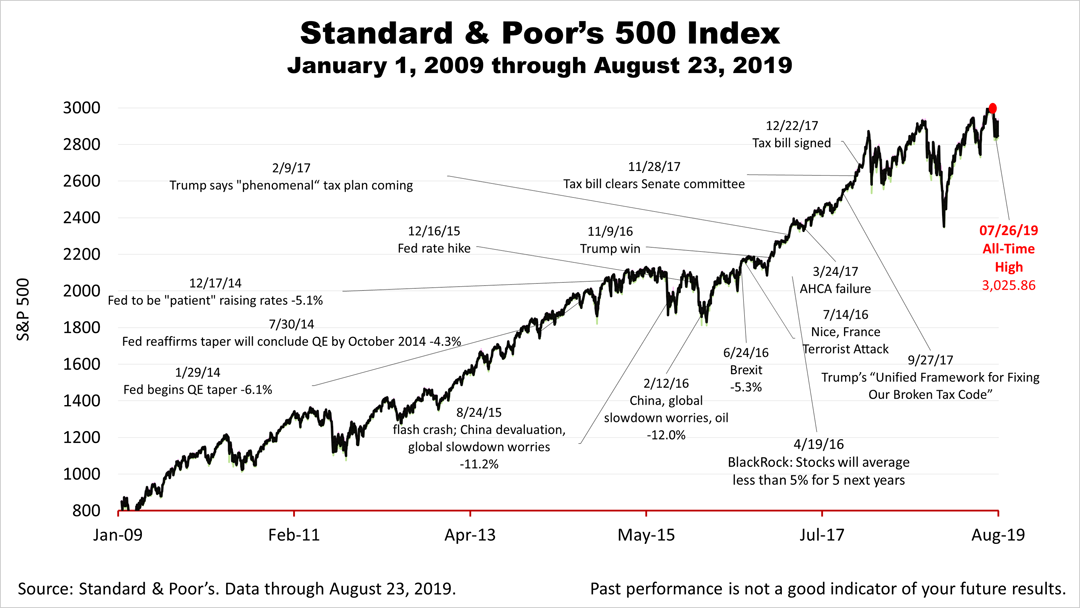

Stocks plunged on Friday, despite Thursday's rise in the U.S. Leading Economic Indicators Index, as the gap between reality and perception of financial economic conditions grew more difficult to discern. Friday's 2.6% plunge in stocks occurred after Thursday's report that the U.S. Leading Economic Indicators Index increased one-half of 1% in July to 112.2, following the one-half of 1% ticks down in May and June. Housing permits, unemployment insurance claims, and stock prices drove the improvement in July. "The manufacturing sector continues exhibiting signs of weakness and the yield spread was negative for a second consecutive month," said Ataman Ozyildirim, director of economic research at The Conference Board, which tracks the LEI monthly. "While the LEI suggests the U.S. economy will continue to expand in the second half of 2019, it is likely to do so at a moderate pace."  The S&P 500 closed the week at 2,847.11, about 5% off its all-time record high. The trade war with China, President Trump's rebuke of the Federal Reserve chairman, slumping manufacturing, and the yield curve inversion heightened volatility in recent weeks and affected perceptions of investors, but the reality of financial economic conditions currently is that the latest retail sales data for July was very strong; the U.S.-China trade war affects U.S. economic growth fractionally; the yield curve inversion is a false alarm caused by unprecedented negative yields in Europe artificially lowering long-term bond yields. While the media outlets are filled with drama, the only thing really unusual is how reality and perception are so hard to discern in the current environment investors face.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results. |