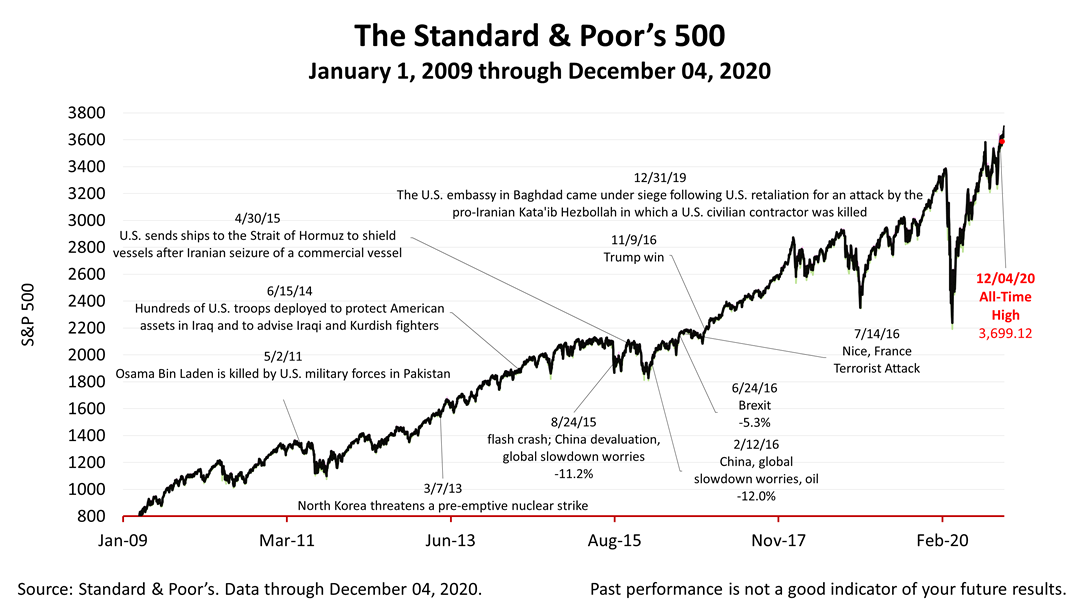

Stocks closed at a new all-time high today despite a bad surprise on the employment situation. What's driving stocks? The combination of a weak bond market and Covid economic conditions are key pieces in today's puzzling investment news.

Friday morning's Bureau of Labor Statistics' release that 245,000 jobs were gained in the U.S. in November, was down from 610,000 in October, and lower than the 457,500 new jobs that economists expected. That was a bad surprise.

Friday morning's Bureau of Labor Statistics' release that 245,000 jobs were gained in the U.S. in November, was down from 610,000 in October, and lower than the 457,500 new jobs that economists expected. That was a bad surprise. Interestingly, it triggered a spate of negative headlines. While major media outlets rang alarms bells, the stock market looked past it. Why?

A revaluation of the stock market may be required due to the poor outlook for the other major asset class – bonds. With long-term bond yields low, inflation at 1.2%, government aid is a cheap and practical way to solve the economic problems facing America in the Covid crisis.

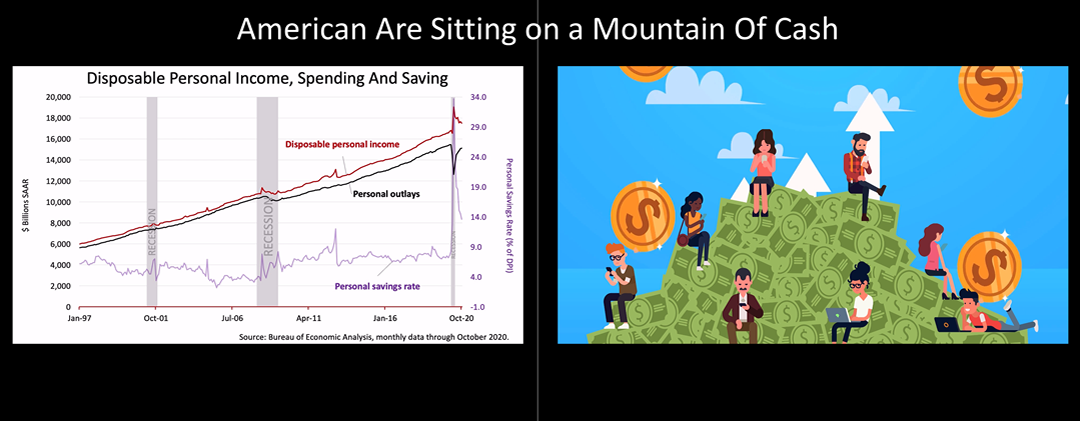

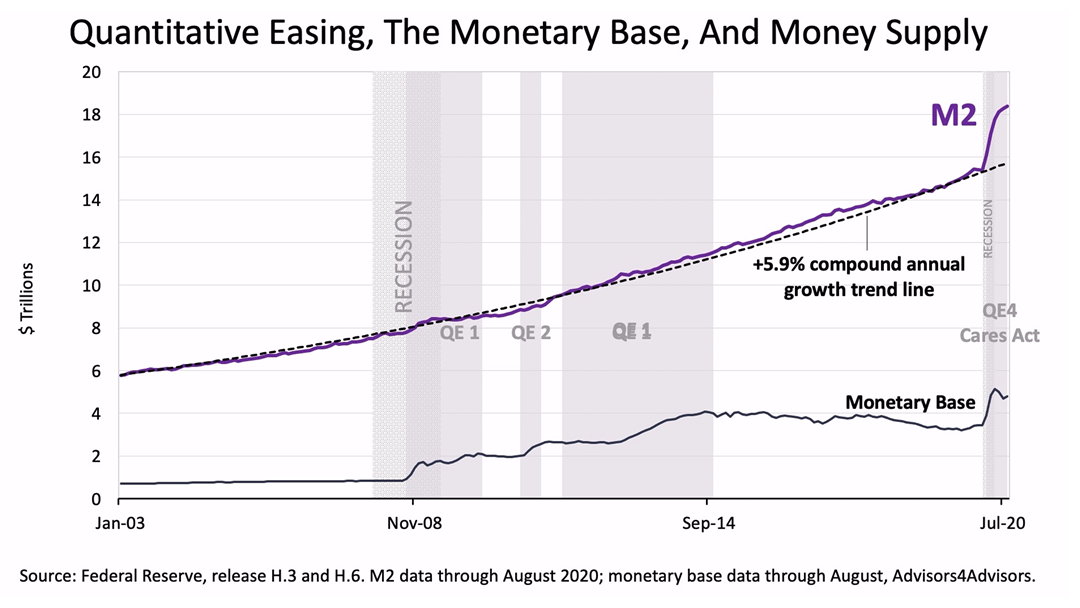

Money supply -- the cash held in savings, money markets and short-term instruments, has gone parabolic due to Covid relief payments and the lower-expense American lifestyle during the stay-at-home Covid period. With additional aid payments from the U.S. government expected to further boost M2 and, thus, savings of Americans, a market melt up is a risk. Timing a market is impossible but understanding financial economic drivers of asset classes is not.

The Standard & Poor's 500 stock index closed Friday at a new all time high of 3,699.12. The index gained +0.88% from Thursday, +1.65% from a week ago, and +49.24% from the March 23rd bear market low. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results. |