The pace of job creation is still strong, and the unemployment rate remains near its all-time low, despite aggressive Federal Reserve rate hikes to slow the economy and stop inflation. But the latest economic data offers a blurry picture of whether there will be a recession, how long it will last and how deep it will be. The U.S. government responded to the Covid-19 pandemic with about $10 trillion in stimulus payments to individuals and businesses between March 2020 and April 2021. The massive stimulus prevented financial panic and an economic depression following the partial shutdown of the economy. It is now complicating the Fed’s job, making it harder to put the brakes on the economy.

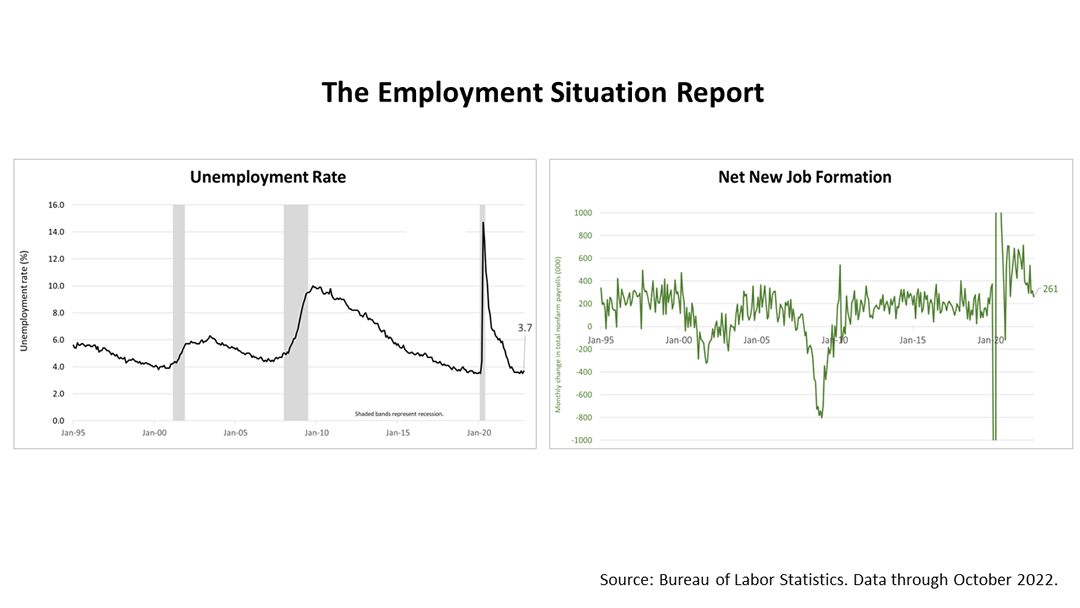

The economy created 261,000 new jobs in October, according to this morning’s report from the Bureau of Labor Statistics, and the unemployment rate rose from 3.5% in September to 3.7%. The pace of job creation is still strong, and the unemployment rate remains near its all-time low, despite aggressive Federal Reserve rate hikes to slow the economy and stop inflation. The Fed’s goal of stopping high-inflation before it becomes ingrained in the American consumer’s psyche is being complicated by a strange brew of rare factors – the pandemic, massive stimulus from the government, supply chain disruptions, and then an unprovoked war by Russia in Ukraine that threatens Europe’s energy needs, as winter is coming. The nation’s central bankers who regulate lending rates met Wednesday. As expected, they raised rates for the sixth time in seven months, and it was the fourth consecutive 75-basis point hike. Hiking lending rates more aggressively than they have in generations is intended to stop inflation but the confluence of so many unusual factors makes the Fed’s job more difficult. The U.S. government responded to the Covid-19 pandemic with about $10 trillion in stimulus payments to individuals and businesses between March 2020 and April 2021. The massive stimulus prevented financial panic and an economic depression following the partial shutdown of the economy. It is now complicating the Fed’s job, making it harder to put the brakes on the economy.

The S&P 500 stock index closed Friday at 3,770.55 gaining +1.36% from Thursday, and declining -3.35% from a week ago. The index is up +68.52% from the March 23, 2020, bear market low and -21.4% lower than its January 3rd all-time high. ​ The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |