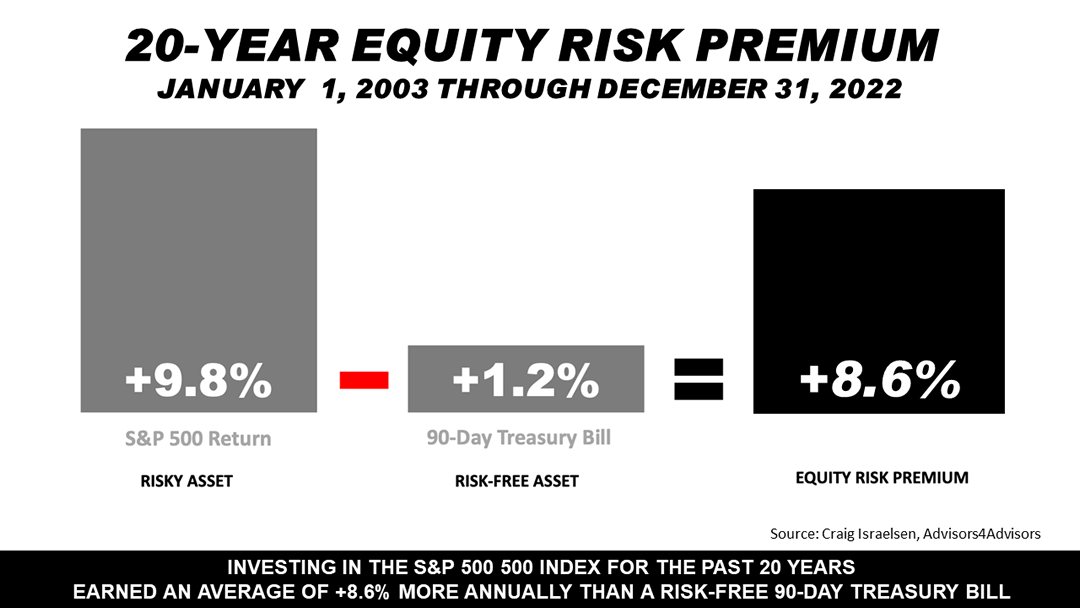

With the bear market turning eight months old on Friday, and stocks 16.6% lower than their previous all-time high on January 3, 2022, it’s wise to remember that putting up with stock volatility has been well worth the risk over the past two decades. The equity risk premium illustrated here shows the reward received annually for tolerating the risk of owning stocks versus owning a risk-free investment. Stocks, as measured by the Standard & Poor’s 500, averaged a 9.8% annual return in the 20 years — more than seven times the 1.2% annualized return on risk-free 90-day U.S Treasury bills. Subtracting the average annual return on T-bills from the return on stocks, the resulting 8.6% is the premium paid annually for taking the risk of owning U.S. stocks over the past 20 years.

To be clear, T-bills are considered a risk-free investment because they’re backed by the full faith and credit of the United States Government. In contrast, stock market investments are not guaranteed. Stock prices fluctuate, depending on the economy and investor sentiment about the future, and stocks are subject to large, unpredictable drops in their value. In fact, if all 500 companies in the S&P 500 index were to go bust, an investment in a mutual fund or exchange traded fund mimicking the blue-chip index could be lost. In addition, no guarantee can be made that the high return on stocks will be repeated in the future. For all these reasons, stocks are a risky investment, and that is why stocks pay a premium over a riskless investment.

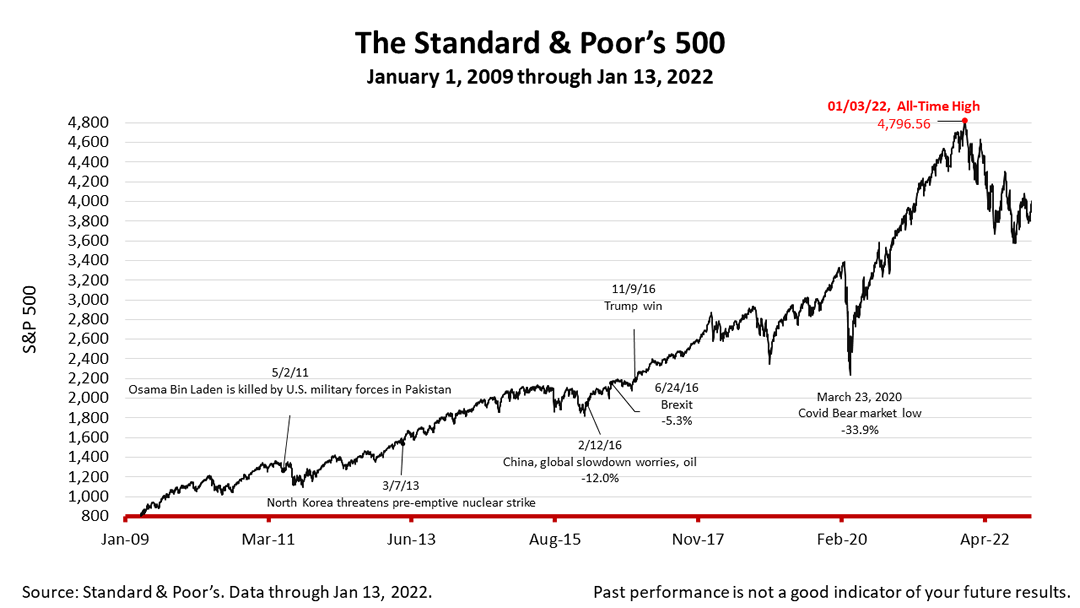

The S&P 500 stock index closed Friday at 3,999.09 gaining +0.40% from Thursday, and up +2.67% from a week ago. The index is up +78.7% from the pandemic bear market low on March 23, 2020, .and -16.6% lower than its January 3, 2022, all-time high. ​ The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. ​​​​​​​​ Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |