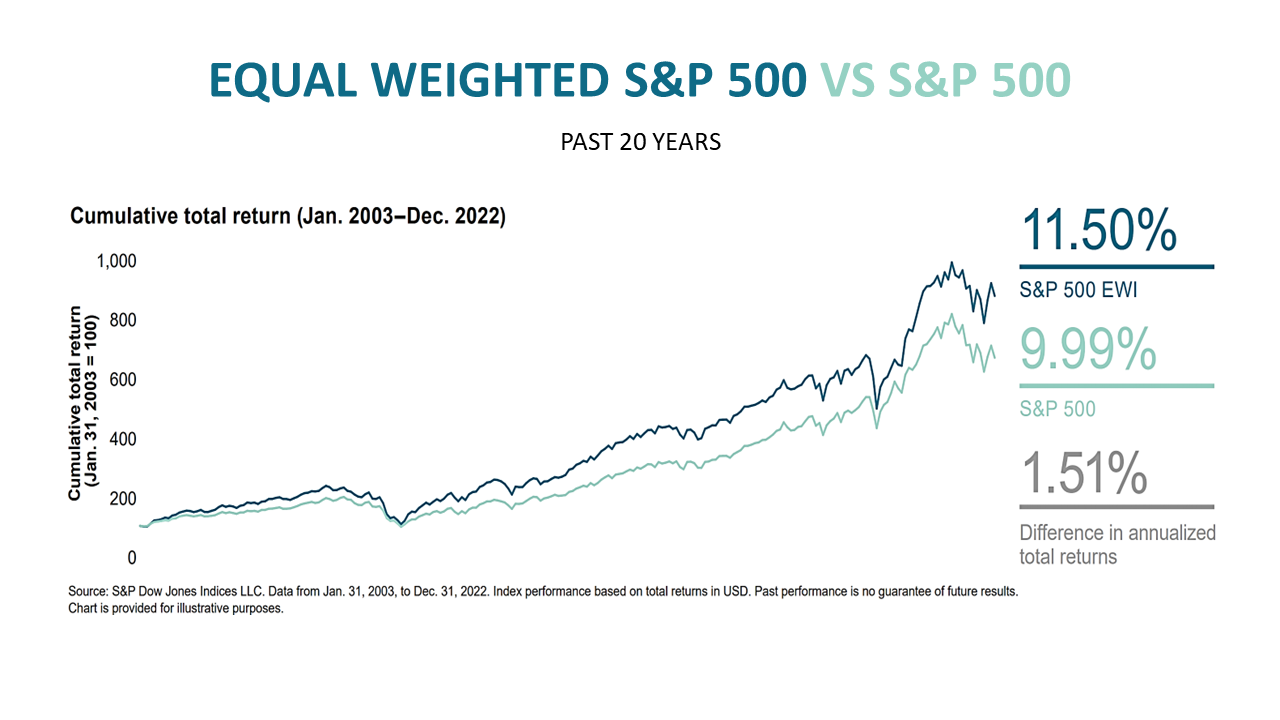

As an investment advisor, it’s frustrating to see people mismanage their portfolios. One problem is that ads make it sound so easy to do it yourself. A common refrain is to buy an index fund and don’t sweat other details. But is index investing really so simple? Perhaps the biggest obstacle to a set-it-and-forget-it index fund investing strategy is that investors are human. When bad times hit, they often abandon their strategy; long-term investing goes out the window in a geopolitical or financial crisis. In addition to maintaining the psychological fortitude to stay committed to a long-term investment strategy during bad times, the other truth is that investing — even index investing — is not as simple as TV ads make it sound. For example, index investing requires periodic rebalancing. With stock indexes historically appreciating annually much more than bonds, a simple 60% stock and 40% bond portfolio is likely to grow overweighted with stocks without rebalancing. In addition, an equal weight version of the Standard & Poor’s 500 index over the past 20 years has outperformed the S&P 500 index commonly advertised by 1.5% annually and might be considered.

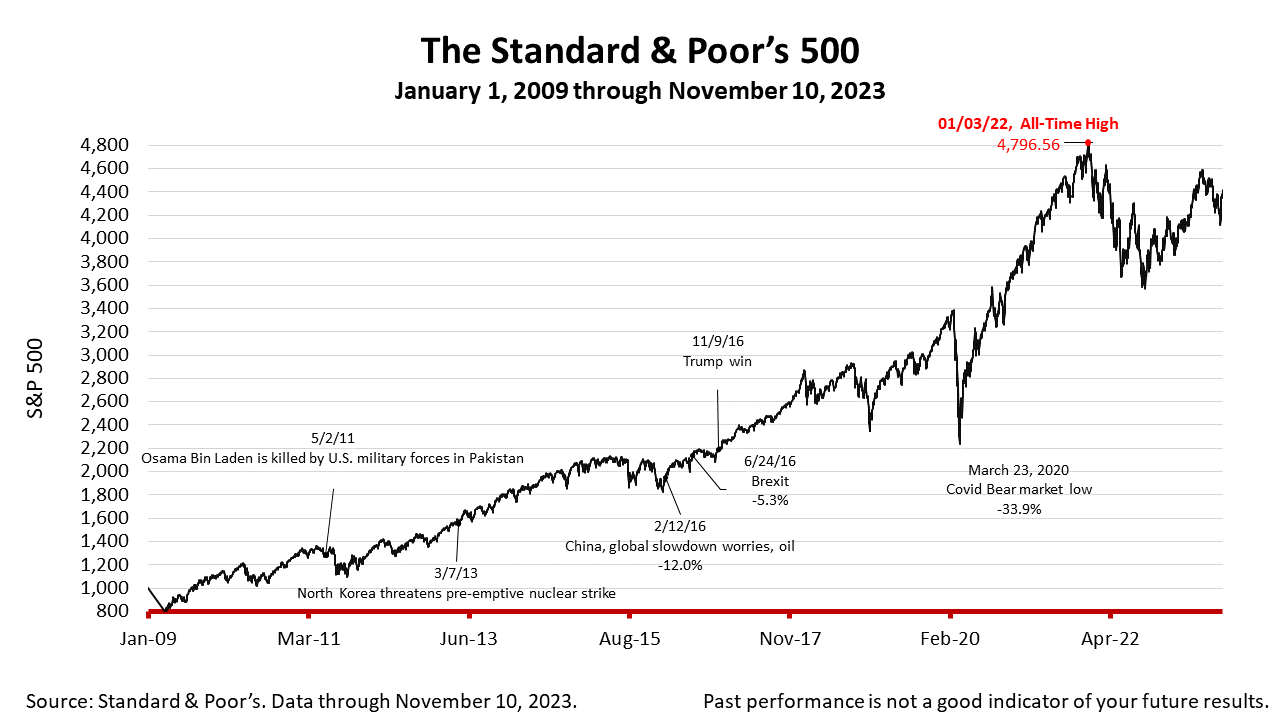

The Standard & Poor’s 500 stock index closed Friday at 4415.24, up +1.56% from Thursday, and up + 1.31% from a week ago. The index is up +97.34% from the March 23, 2020 bear market low and down -7.95% from its January 3, 2022, all-time high The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. ​​​​​​​​ Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |