Amid the suffering and tragedy of the worsening pandemic, here are three timely tips to build wealth over the long haul.

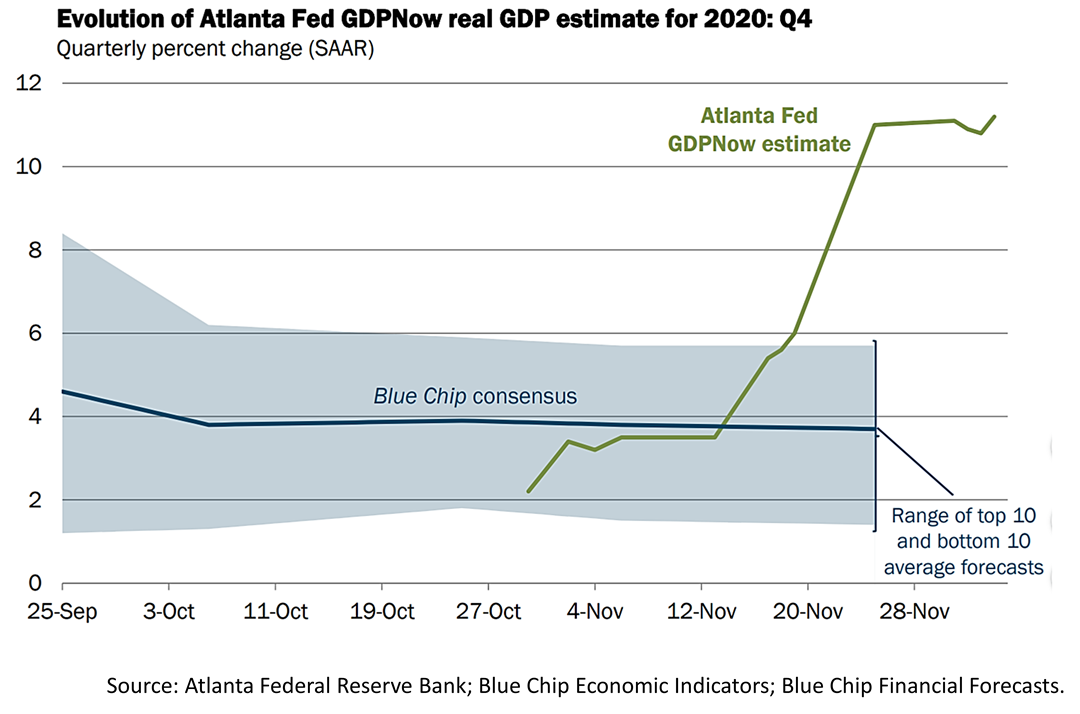

1. The Atlanta Federal Reserve’s running estimate of real GDP growth is much higher than the consensus forecast, indicating 2020 may end with a positive surprise. The consensus forecast of economists is for a growth rate of 4% for the United States economy in the fourth quarter of 2020, but the GDPNow algorithm devised by the Atlanta Fed indicates the quarterly growth rate is running at a whopping 11.2%! GDPNow grows more accurate as the end of the quarter nears. and, with just 27 days left to the end of the quarter, the December 4 reading was way above expectations of economists.

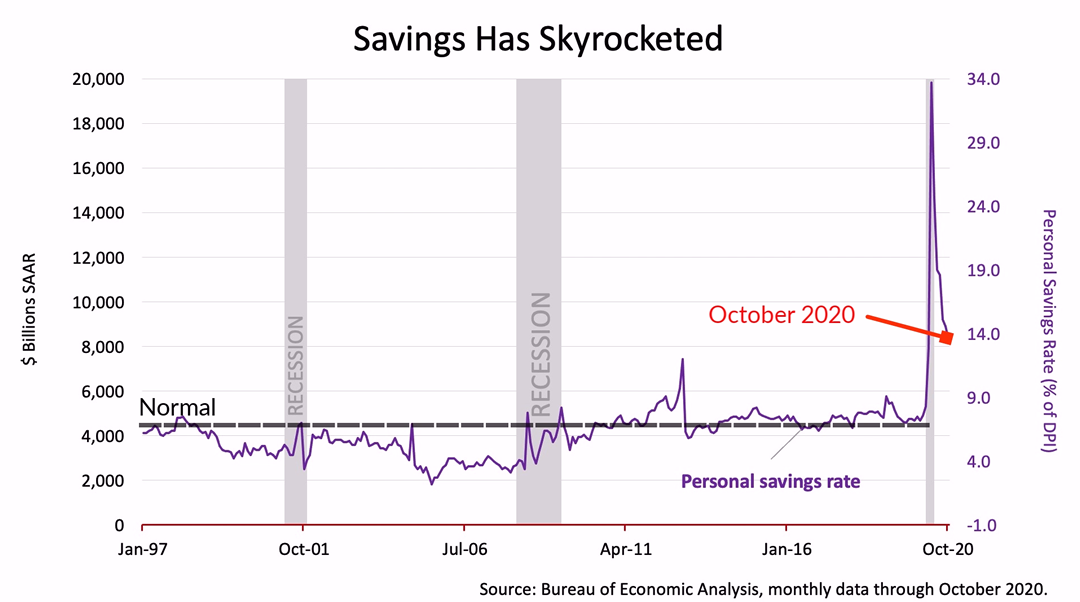

2. A second round of federal emergency relief is being negotiated by federal lawmakers. Both houses of Congress are expected to draft and adopt the aid package before legislators head home for the holidays on Dec. 11. The $908 billion plan under consideration would add to the mountain of cash Americans have assembled in recent months in checking, savings and money market accounts. The history-making cash hoard was built primarily from direct Covid relief payments, but staying home to avoid infection has also caused an unprecedented expansion of the money supply. A bleak outlook for bond income could send some of the cash sitting on the sidelines into housing and stocks. 3. A second round of funding for the Paycheck Protection Program (PPP) to aid small businesses is contained within the draft of the emergency aid legislation expected to be enacted. If enacted, the second round of PPP aid will extend a lifeline to the millions of business owners who have taken a beating in 2020. The first round of PPP was widely criticized as favoring larger companies at the expense of "mom and pop" shops, so the second round is designed to be different. Questions about potential loan forgiveness and whether business owners who already received PPP loans will qualify for a second round of forgivable loans will be answered in our news stream in the days ahead. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results. |