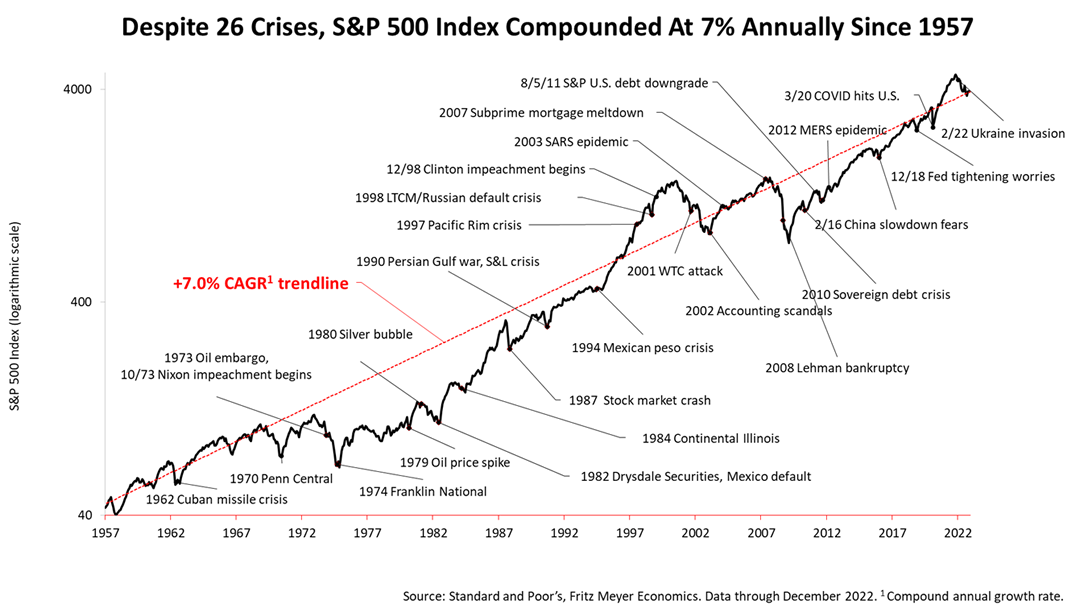

With the investment outlook uncertain, as it is almost always, this chart is a reminder that crises have come and gone throughout modern history and $1 invested in the U.S stock market, as measured by the Standard & Poor’s 500 stock index, compounded at an annualized rate of 7% for 65 years ended December 31, 2022. While the stock market’s unpredictable in the near term, don’t let it be a distraction from another important wealth building topic: A smart thing to do at this moment is to determine how to take advantage of the newly enacted SECURE Act 2.0 in 2023. This new reform to retirement tax law affects Americans of all income and age groups. The new law, commonly called SECURE 2.0, was actually titled by Congress, “The Securing a Strong Retirement Act 2.0.” SECURE 2.0 expands on the Setting Every Community Up For Retirement Enhancement (SECURE) Act signed by President Donald Trump in December 2019. SECURE 2.0 is part of a massive government spending bill, the $1.7 trillion Consolidated Appropriations Act of 2023. The 4,155-page bill funds the federal government through September 30, 2023, and contains provisions addressing numerous national financial priorities, such as aid to Ukraine, and funding federal disaster relief as well as retirement funding. Some of the new rules on retirement became effective as of January 1st 2023, while others will not kick in for many years. In a complex world, this article is not advice but presents facts, analysis, and uncommon financial knowledge for education purposes. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |