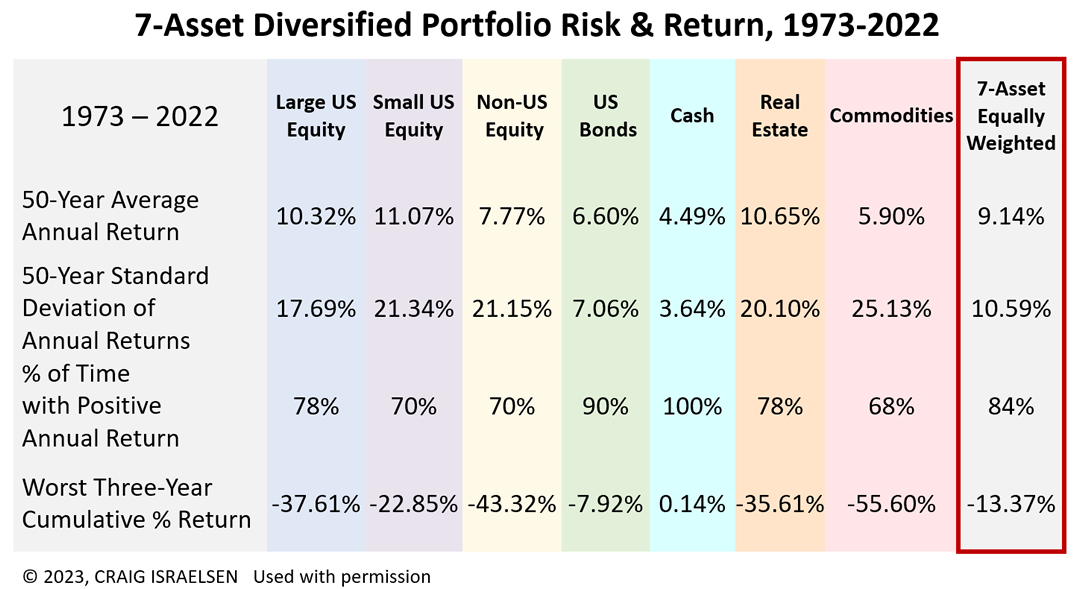

Investment success hinges largely on getting the answer right to this question: Would you accept 10% less return on stocks annually to experience 40% less volatility than stocks? If so, congratulations! You’re on your way to developing realistic investment expectations. This article is not intended as advice but only to help permanent investors develop expectations about generating retirement income or building enduring family wealth. This table below shows the annualized risk and returns of seven distinct assets for the 50 years ended December 31, 2022.

These seven assets were selected because, as a group, they comprise a diversified portfolio and have been indexed publicly since 1970. The red rectangle highlights the risk and return of owning a portfolio comprised of equal weightings of the seven indexes. The data were collected by Craig Israelsen, Ph.D., who teaches portfolio management to students at Utah Valley University and to financial professionals on Advisors4Advisors. Fifty years of risk and returns is a lot of history, and history rhymes or repeats periodically. Thus, this is a constructive way to start to set your investment return expectations over the rest of your lifetime, assuming you can adhere to a discipline. Of the seven assets, small company stocks had the highest return, 11.07%. It also had the highest risk, as measured by standard deviation, at 21.34%. The asset class with the best risk/reward tradeoff was large-company stocks, as measured by the Standard & Poor’s 500 stock index. The seven-asset portfolio was much more efficient and offered 90% of the return of the S&P 500 but with 40% less volatility. If you align your expectations with data in this table, it may help you hold firm as the bear market approaches its one-year anniversary on June 13, 2023. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |