The list of good news for investors grew longer on Thursday, further defying two highly reliable recession signals. Positive fundamental factors outnumber signs of weakness, amid skepticism about the future. This is how bull markets always surprise investors.

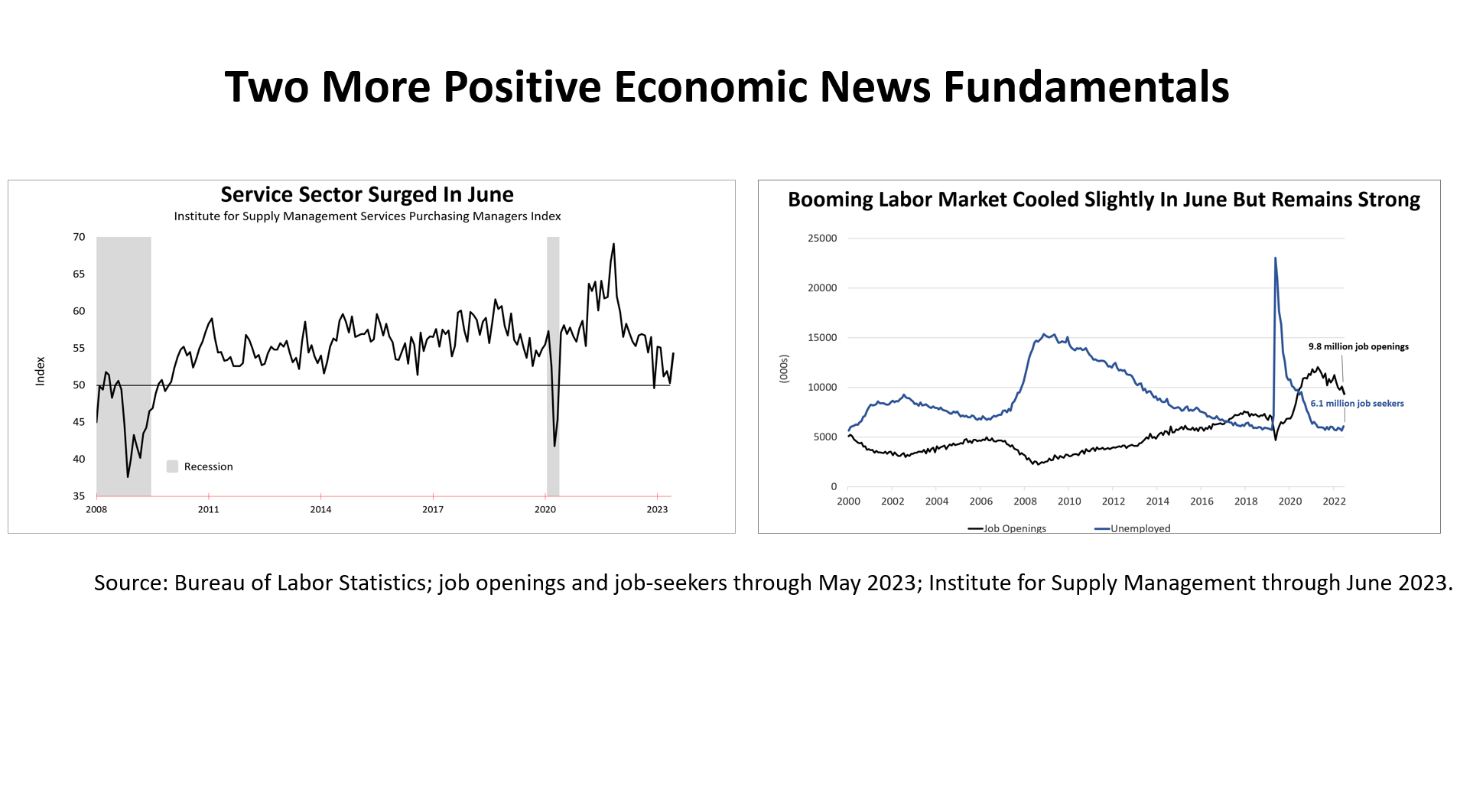

The service sector of the economy surged 3.6 percentage points in June, the Institute for Supply Management reported. The service sector accounts for nearly 90% of U.S. economic growth. In addition, the number of job openings declined from 10.1 to 9.8 million, as the booming labor market cooled slightly from red-hot but remained strong.

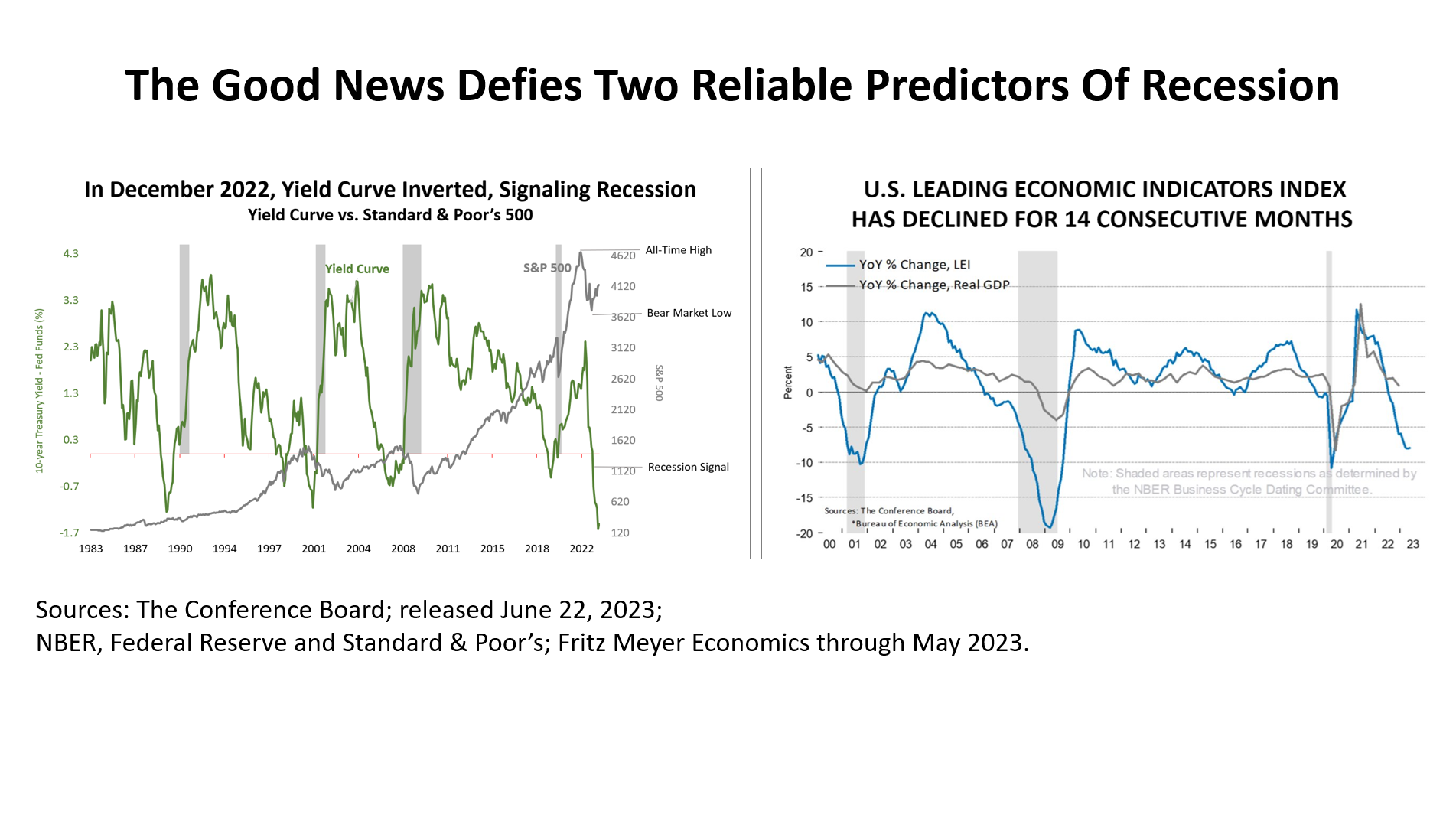

The good news Thursday came amid a 14-month collapse of the U.S. Leading Economic Indicators index and an inversion of the yield curve that began in December 2022. These two normally reliable warning signals of a recession have been signaling a slowdown is imminent for many months. However, the data for months has been positive. Anomalies in the economy since the pandemic have made historically reliable indicators less reliable. A new bull market began in June, when the Standard & Poor’s 500 stock index rose by more than 20% from its bear-market low of October 12, 2022. Consumer sentiment never recovered fully after the pandemic and remains far below the historical norm, even as the economy keeps strengthening in defiance of expectations. That’s why bull markets always surprise investors. While skepticism is widespread, planning now for the next cycle of expansion is wise. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |