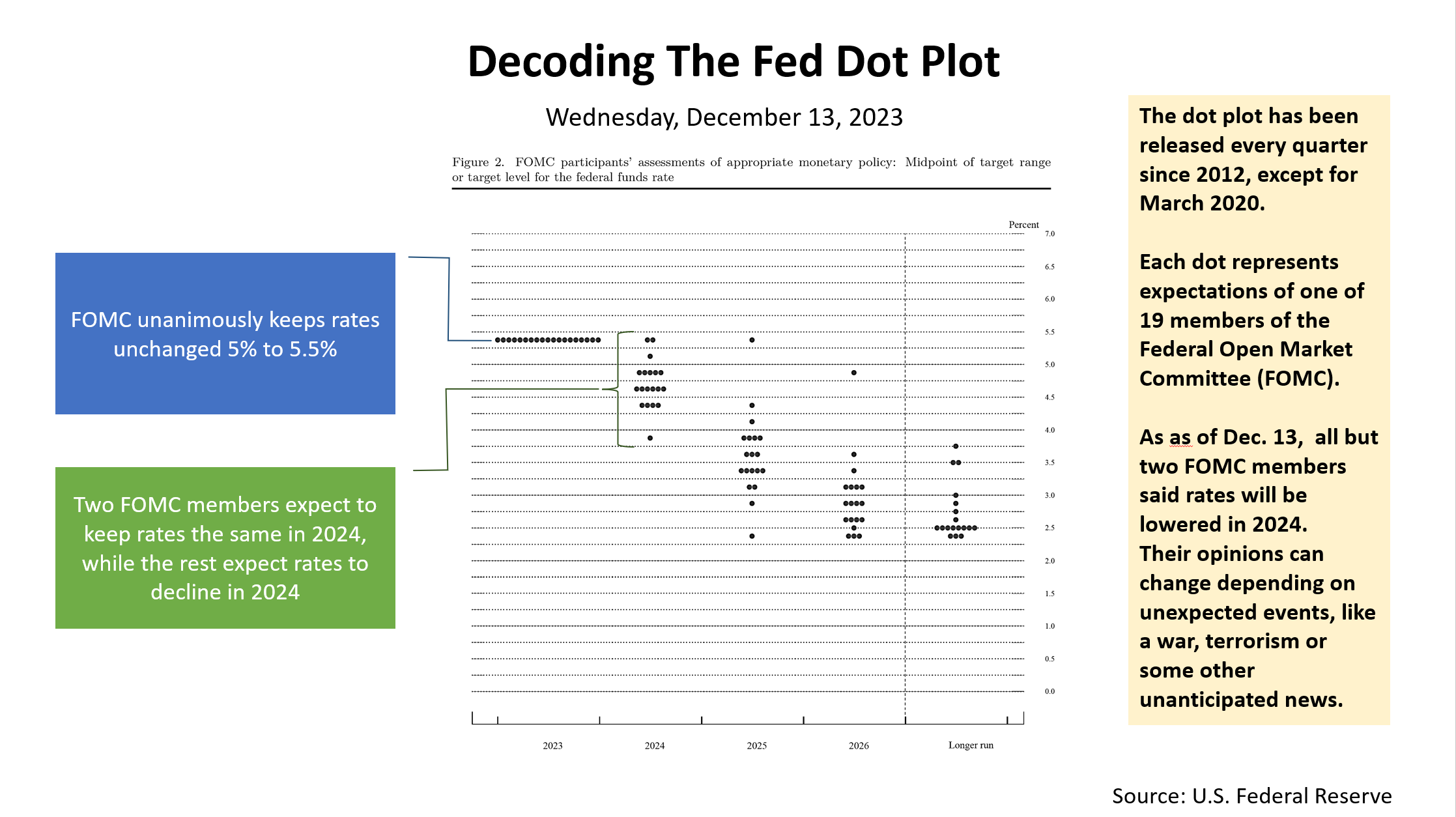

To promote transparency and free markets, the Federal Reserve System began publishing the opinions of the 19 U.S. central bankers that decide interest rate policy. Their expectations of appropriate interest rates in 2024 are summarized in the chart below. The Federal Open Market Committee (FOMC) has published the expectations of each banker in a chart like this every quarter since 2012. Yesterday a new “dot plot” was released by the FOMC.

The dot plot promotes transparency and build confidence in the free-market system that distinguishes the United States from other nations and helps explain why it is the world’s largest economy, why the U.S. is different from other economies and remains the leading world economy. The dot plot released yesterday, Wednesday, December 13, could change if something unexpected were to happen, such as a war, economic crisis, natural disaster, or something unimaginable. As of yesterday, the 19 members of the FOMC — leading U.S. economics professionals — unanimously said keeping rates the same was best for right now. In addition, all but two of the 19 members of the FOMC expected to reduce the Fed’s benchmark lending rate in 2024. The Fed is designed to be independent of politics. For example, Jerome Powell, chairman of the Fed, was nominated to be a member of the Fed by President Barack Obama, in 2012. He was elevated to the chairman by President Donald Trump and renominated by President Biden. The U.S. central bank has evolved in recent decades as the world has changed, and its recent success in managing the economy is noteworthy. Inflation had surged because of massive stimulus payments to Americans to keep the economy afloat in 2020 and 2021 after the partial shutdown of the U.S. economy. Supply chain interruptions after the pandemic were followed by oil price hikes related to Russia’s February 2022 invasion of Ukraine. The Fed responded by raising the lending rate it charges big banks by more than 1000% in 11 rate hikes from March 2022 to July 2023, and it has kept the Fed funds rate the same for five months. If the FOMC’s forecast is right, it would be good news for stock investors. Lower interest rates will make owning bonds less attractive relative to stocks. Decoding the dot plot is hard. So is understanding the reason the American economy remains the No. 1 destination for investors worldwide and keeping this concept top of mind when investing. None of the information above is financial advice. If you’d like a personal consultation, please contact us. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |