Retail sales dropped sharply in December and business-owner optimism plunged but events in the Washington, D.C. overshadowed everything. Yet share prices of America’s blue-chip stocks did not drop very much and the consensus forecast of economists released today predicts a strong recovery for the next 21 months. Here’s the financial economic news investors need to know right now.

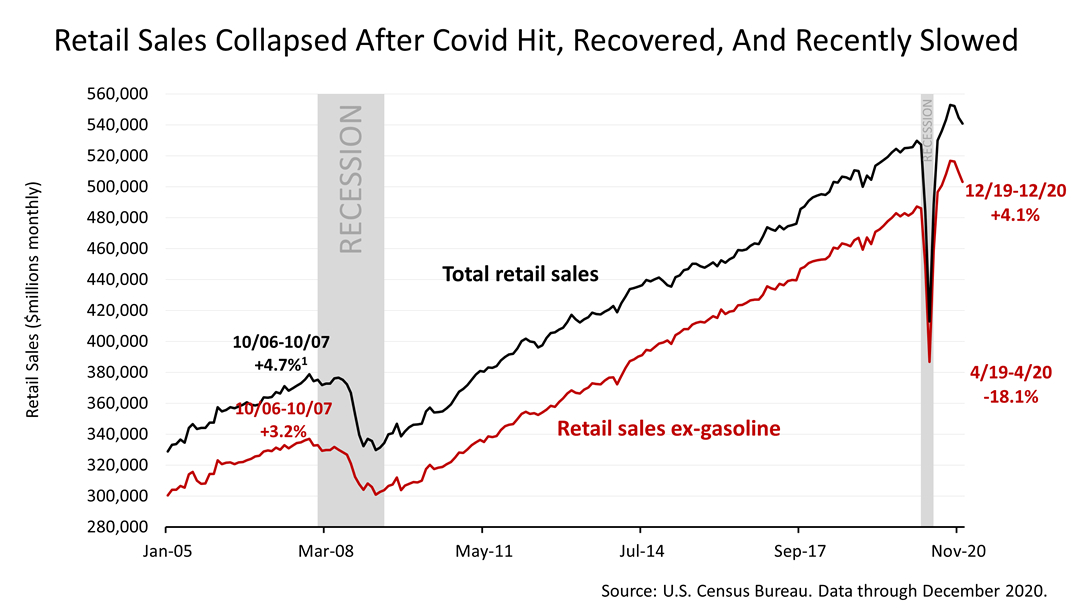

Retail sales, excluding gasoline because its volatility distorts the trend, declined seven-tenths of 1% in December, according to data released this morning by the U.S. Census Bureau. December retail sales, excluding gasoline, rose by +4.1% compared in the 12 months ended December 31, 2020. Retail sales comprise 30% of GDP and its slowdown is evidence that the post-COVID recovery that began last April has lost strength.

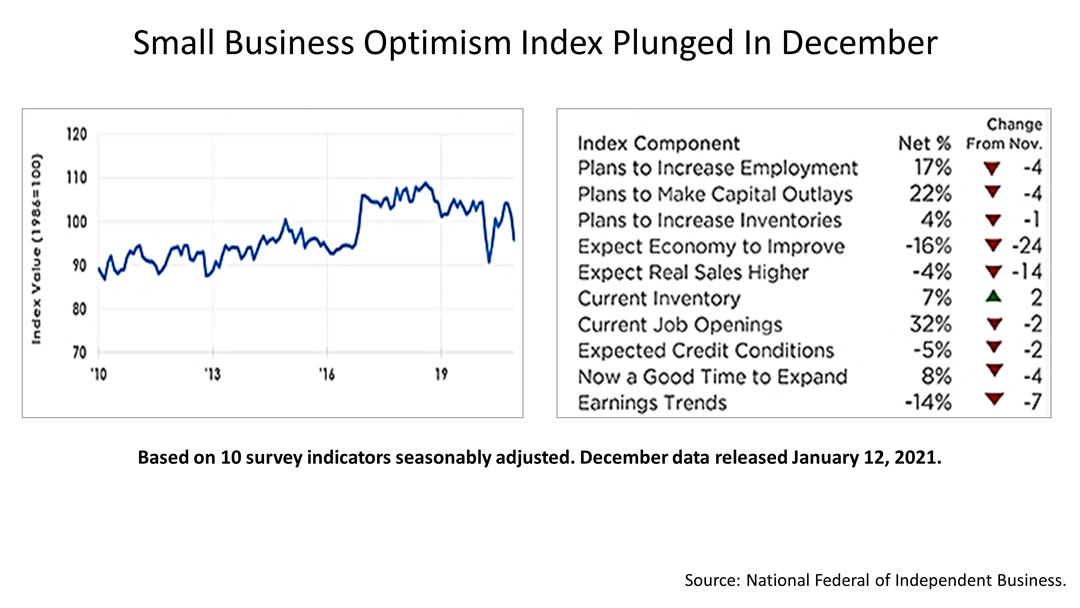

Optimism among small business owners plunged in December. According to the National Federal of Independent Business, which surveys small business owners every month, optimism declined 5.5%, falling below its average level since 1973. NFIB says small businesses are concerned about the new administration’s policies and the increased spread of COVID-19 causing renewed government-mandated business closures across the nation. Small business created more than half of the new jobs in the last decade. The optimism index has averaged a reading of 98 since 1973 and fell to 95.9 in December.

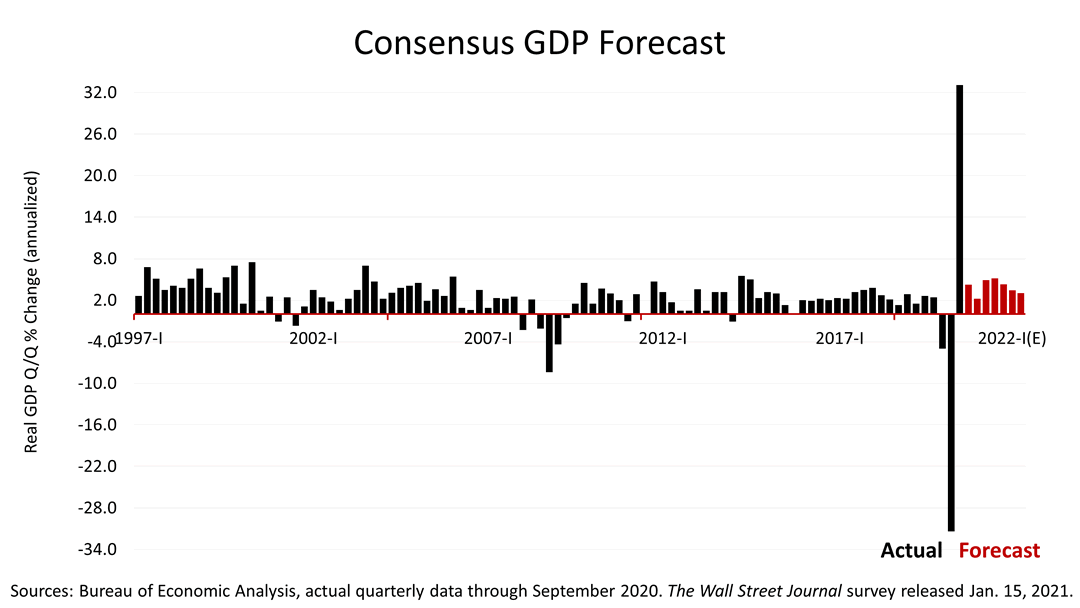

Despite the drop in retail sales and business-owner optimism, the consensus forecast of 60 leading economists surveyed monthly by The Wall Street Journal released today remained sanguine. Economists expect the U.S. to grow by 4.3% in the quarter ended December 31, 2020. A 2.2% quarterly rate of growth is forecast for the first quarter of 2021. Significantly higher growth rates are projected for the quarterly periods through the end of September 2022. Despite the bad news about December, the U.S. is not expected to suffer a double-dip recession, according to the consensus of economists surveyed by The Journal.

The bottom-line this week, amid the political turmoil, the drop in retail sales and plunge in business-owner optimism: the Standard & Poor’s 500 stock index closed Friday at 3,768.25, a loss of -0.72% for the day, and it dropped -1.48% from last week’s all-time high. Stocks are valued +50.98% higher than their March 23rd bear-market low. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results. |