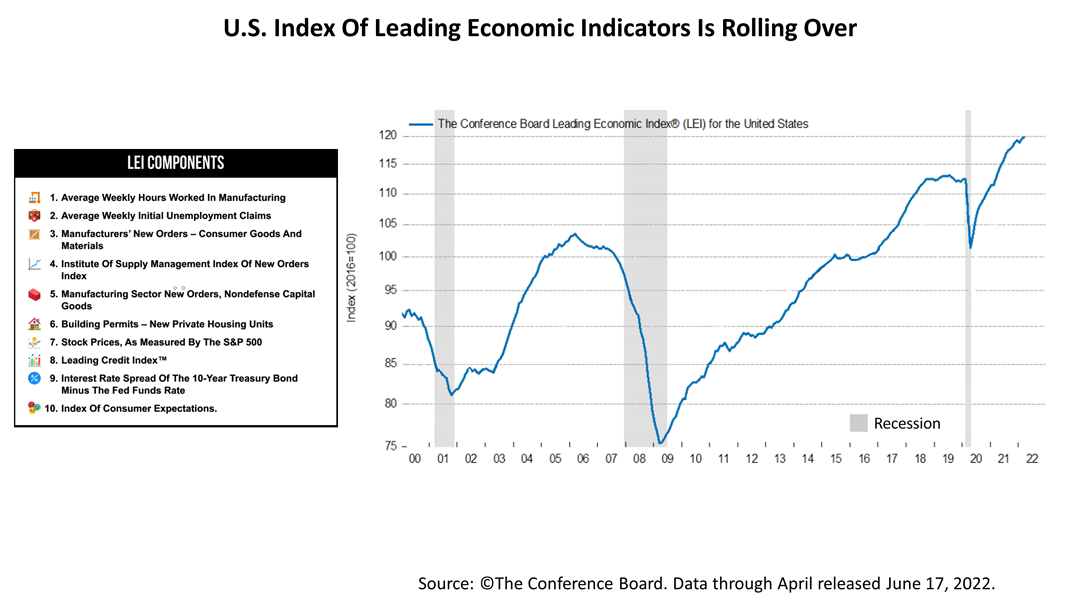

In an ominous sign a recession is on the way, the U.S. Index of Leading Economic Indicators ticked down four-tenths of 1% in May, following a decline of four-tenths of 1% in April. The LEI has a history of rolling over definitively before every recession since 1950, except for the Covid-19 recession. Comprised of 10 indexes, the LEI is a reliable forward-looking indicator of the foreseeable future. The LEI was doing just fine until April, and May’s drop is one of a few influential economic growth indicators to turn negative in the last couple of weeks.

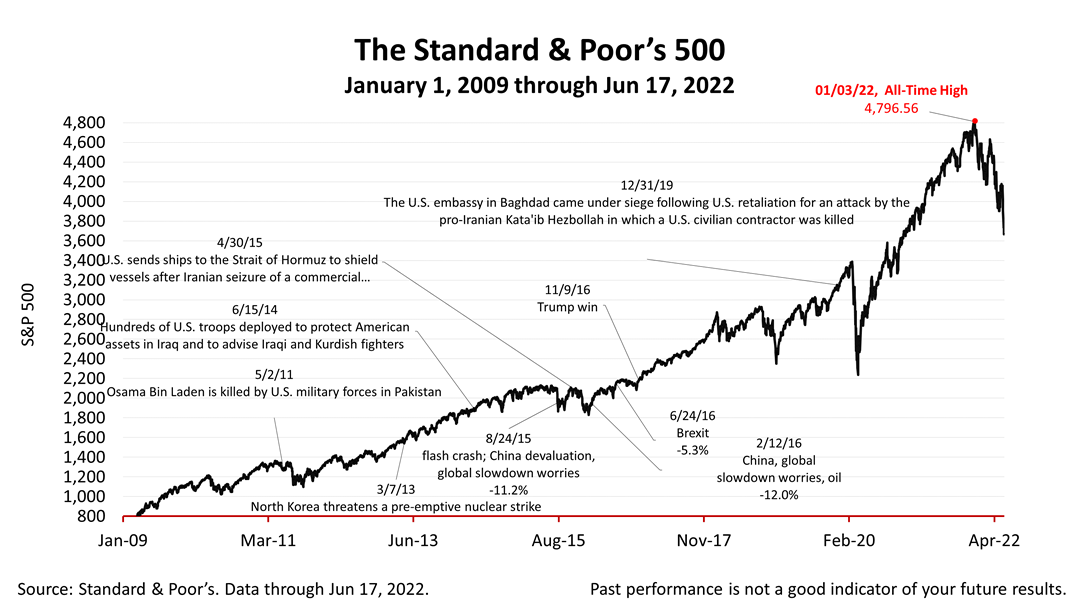

The Standard & Poor’s 500 index is one of the 10 components in the LEI. The plunge in stock prices in anticipation of an economic slowdown was a key factor accounting for the slump of the LEI for the past two months. Financial news headlines were uniformly bad an hour after the close of trading on Friday. The bad week for stocks will show up on next month’s LEI, an ominous sign.

The Standard & Poor’s 500 stock index closed this Friday at 3,674.84. The index gained +0.22% from Thursday but plunged -5.96% from a week earlier. The index is up +48.62% from the March 23, 2020, bear market low and down -26.48% from the January 3rd all-time high. With gloom and doom now saturating the media and national financial psyche, bright spots remain: Household balance sheets are strong and the ability of American to pay their monthly expenses remains extremely strong by historical standards; consumers continue spending; and state government are flush with cash due to the unexpected Covid expansion. Stay focused on the next economic recovery. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |