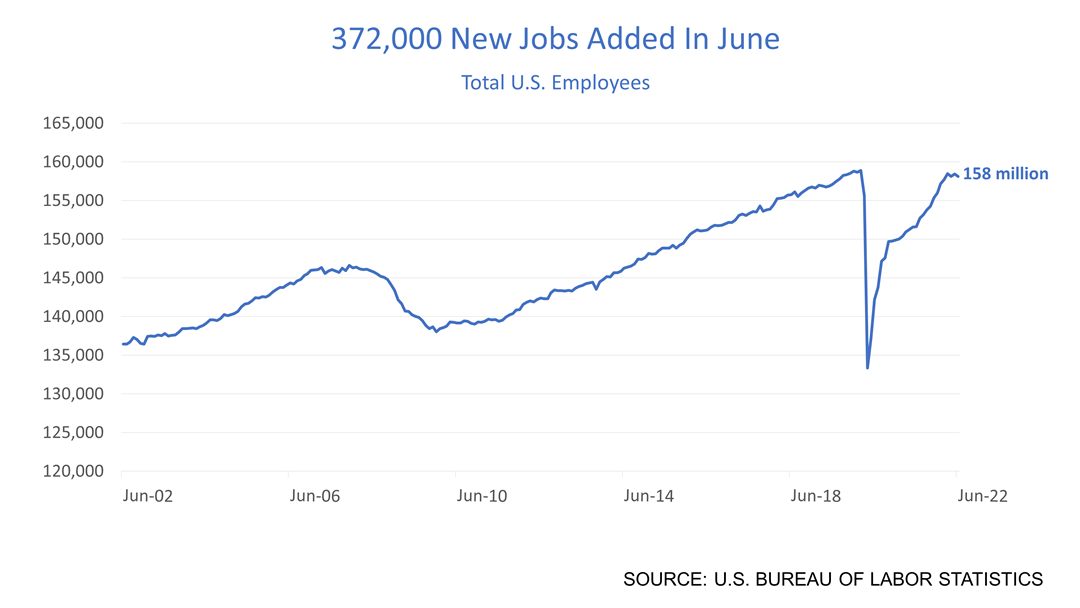

The U.S. economy added 372,000 new jobs in June, easing fears of a recession. Strong job creation makes a three-quarter of 1% rate hike likely on July 27, when the Federal Reserve releases its next policy statement. The Wednesday, July 13, 8:30 a.m. ET, Consumer Price Index (CPI) release is the next important economic indicator to watch. If the pace of inflation eases, as measured by the CPI, then a “soft landing” could still be possible, and a recession may be avoided while the Fed fights to prevent a high-inflation mentality from becoming a permanent feature of the American consumer’s financial psyche. Notably, the number of full-time employees grew to 158 million in June. That’s about 700,000 fewer employees than at the last peak in the number of U.S. employees in February 2020, just before the pandemic struck. However, the labor participation rate declined, and the labor market is tight, which puts pressure on wages. This is a complicated period in American financial history. While our weekly updates try hard to simplify investments news, these concepts are complicated and making decisions strategically is not so easy. The tumult we have lived through since February 2020 is an unusual event in world financial history. It’s a time when professional advice makes sense.

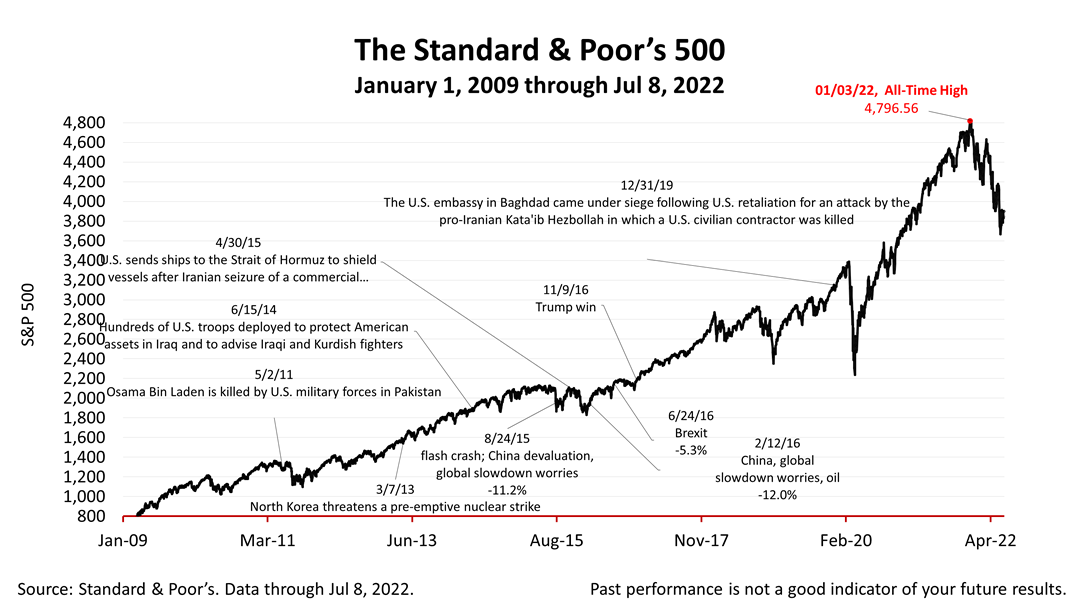

The Standard & Poor’s 500 stock index closed this Friday at 3,899.38. The index lost -0.08% from Thursday and was up +1.92% from last week. The S&P 500 is up +54.16% from the March 23, 2020, bear market low and down -20.63% from its last record high on January 3rd. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |