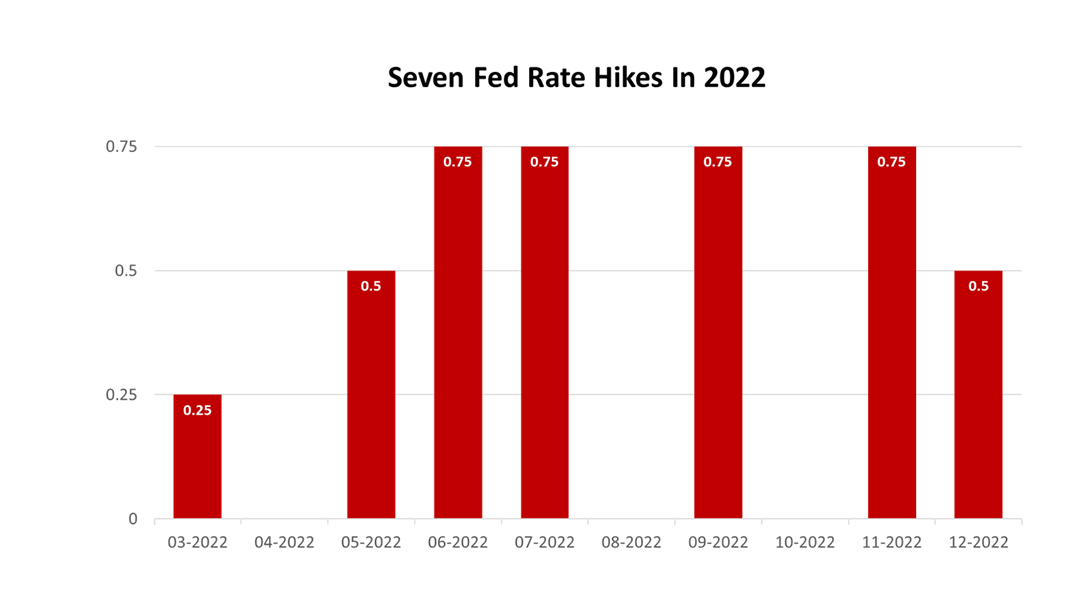

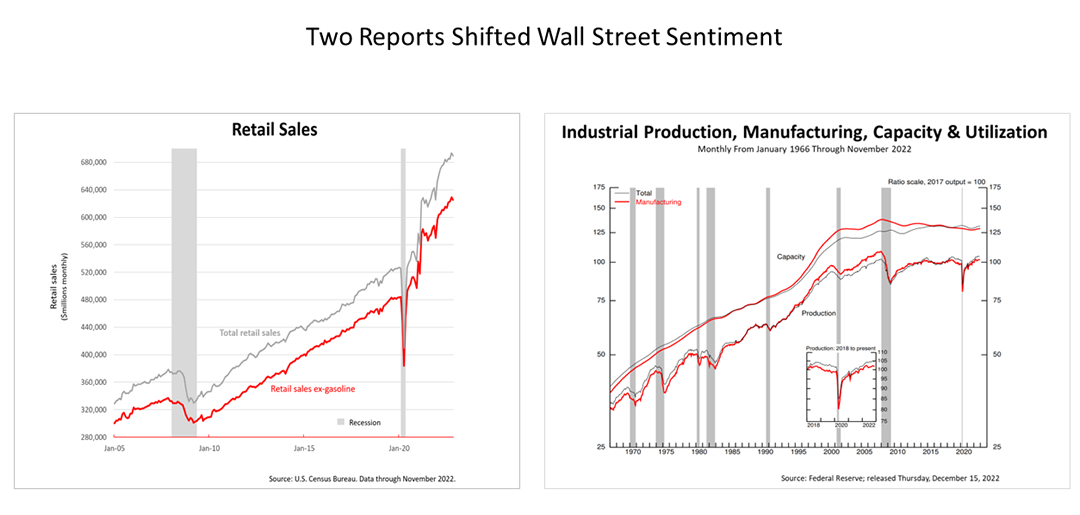

Wall Street sentiment quickly shifted Thursday and Friday. After November retail sales data from the U.S. Census Bureau and a Federal Reserve System report on industrial production were released Thursday morning, a two-day stock market plunge ensued. The two bad economic data surprises came after the Federal Reserve Board chair, Jerome Powell, said at a press conference on Wednesday that policymakers had voted at their December 13-14 meeting to raise the central bank’s lending rate by a half-point. It was the Federal Reserve Bank seventh interest rate hikes in the last 10 months. “We think that we'll have to maintain a restrictive stance of policy for some time,” Mr. Powell said at the 45-minute press conference. “Historical experience cautions strongly against prematurely loosening policy.” Wall Street initially reacted positively Wednesday after the Fed chair’s remarks. That changed on Thursday.

November retail sales, excluding gasoline, increased by +6.4% in the 12 months through November. However, after inflation, as measured by the consumer price increase index, retail sales were only up four-tenths of 1%. Eighty-eight percent of retail sales are goods, as opposed to services, and retail sales drive 30% of total U.S. gross domestic product. Meanwhile, U.S. industrial production declined by two-tenths of 1% in November, and manufacturing output decreased six-tenths of 1%.

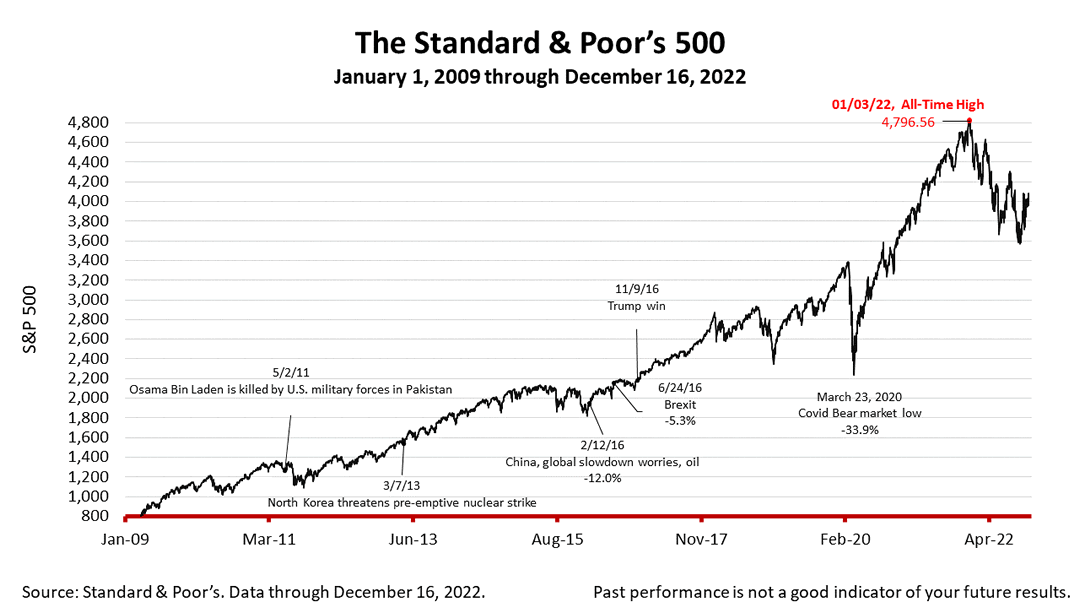

The bad data reports were the proximate cause of the shift in sentiment. They made more Wall Street investors doubt whether the Federal Reserve could engineer a soft landing – tightening monetary policy while causing only a slight recession in 2023 or, possibly, no recession at all. After falling -2.5% on Thursday, the S&P 500 stock index lost another -1.1% on Friday, closing the week at 3,852.36. Down -2.08% from a week ago, the index is up +72.18% from the March 23, 2020, bear market low and 19.68% lower than its January 3rd all-time high. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |